As U.S. Opens Door to Clean Energy Shift, Hanwha Steps Through

On August 16, 2022 the U.S. signed into law the Inflation Reduction Act (IRA), a sprawling piece of legislation packed with incentives meant to cut carbon emissions and jumpstart America’s transition to clean energy. The Act is being called the most meaningful climate bill ever passed in the U.S., signaling a readiness to take the much-needed steps to retool U.S. energy and infrastructure and lower the country’s reliance on fossil fuels.

But while the IRA paves the way for a transition to green energy, making those changes possible will take a commitment from clean tech leaders with the capacity and track record to make the necessary projects a reality—a task Hanwha and other companies may already be well-positioned for.

What is the Inflation Reduction Act?

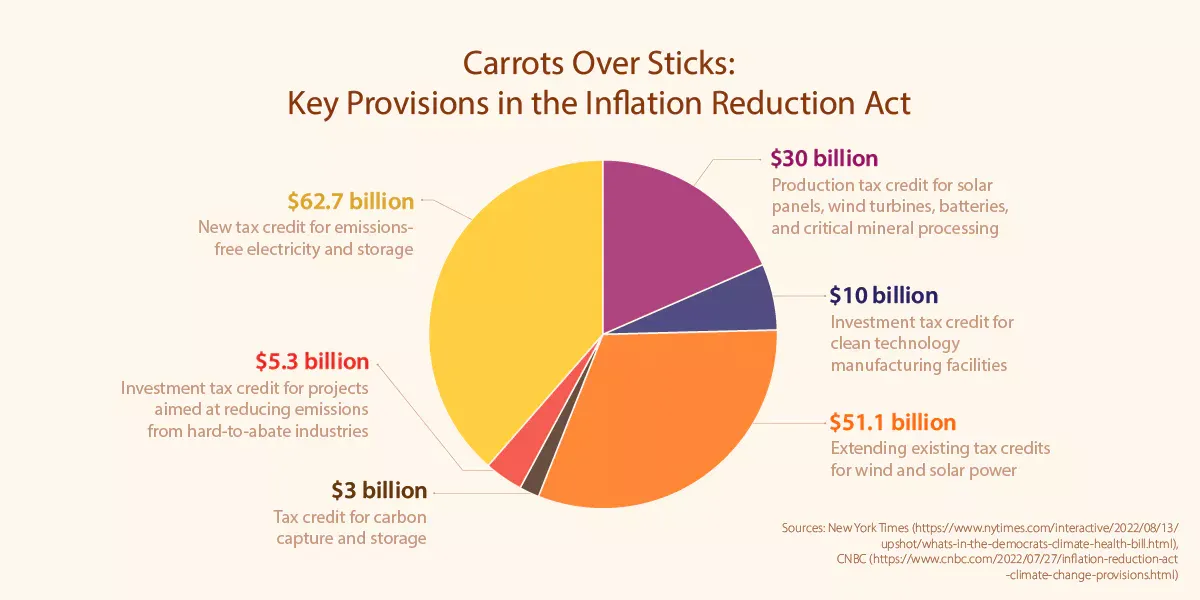

Hopes for the Act’s efficacy are mostly riding on its incentive-driven approach. Instead of enforcing a carbon tax or other penalty in order to slow global warming, the IRA offers large subsidies to green-thinking companies like Hanwha, with some USD $369 billion in funding for U.S.-based climate and energy initiatives. It’s using carrots instead of sticks to target a roughly 40% cut in greenhouse gas emissions compared to 2005 levels, and those carrots extend to nearly every corner of the clean energy sector.

An estimated USD $30 billion has been earmarked for producers of renewable tech like solar, wind, and batteries, along with the parts and critical minerals that power them. This is particularly good news for the solar industry, as the prior investment tax credit for solar energy property was scheduled to be phased out by 2023. Another USD $10 billion will go to tax credits for companies that build clean manufacturing facilities in the U.S., with the goal of enticing manufacturers to make greener choices or move their existing clean manufacturing technology stateside. This also means solar modules that use domestically produced components, like cells, polysilicon, and modules, are eligible for new tax credits as part of this push to expand the U.S.-based clean energy supply chain.

The IRA also aims to help shake up carbon dependency in hard-to-abate industries like iron, steel, cement, and chemical production—areas with energy demands that so far only fossil fuels have been able to meet. It includes a USD $5.3 billion incentive to help decarbonize the energy-intensive industrial sector. Among the developments that could help hard-to-abate industries decarbonize is hydrogen, a fuel source that is actually the most abundant element in the universe. The Act sees hydrogen as a major tool in the fight against climate change and a building block in America’s energy transition. As such, it offers both direct and indirect incentives aimed to bring momentum to the growing industry.

The IRA will also encourage the development of apprenticeship programs and prevailing wages for workers by offering a “bonus” tax credit for clean energy producers who do so, incentivizing producers to offer competitive salaries and training programs. The IRA stipulates that production and investment tax credits at the highest levels will only go to those who can meet the wage and apprenticeship requirements laid out by the Act, encouraging manufacturers to create high-quality green jobs and programs to build employee skillsets.

Taken together, these and other provisions in the IRA are designed to persuade clean tech leaders like Hanwha that have been investing in U.S. production to stay the course, while encouraging others to get on board with the goal of lowering overall greenhouse gas emissions. If these policies work as intended, those combined investments could help the U.S. avoid roughly 6.3 billion tons of greenhouse gas by 2030, making this the single most important climate investment in U.S. history by far.

Bringing Hanwha’s Global Clean Tech Leadership Stateside

Hanwha Qcells plans to expand its solar business.

The success of the IRA will come down to what kind of commitments and actions its tax incentives can draw from corporations, and in that field, they already appear to be bearing fruit.

In August 2022 Hanwha Solutions, the company that heads up Hanwha’s solar power production, began considering additional investments to its U.S. solar operations. Now that President Biden has signed the IRA into law, Hanwha is weighing additional investments in vertical integration for their solar value chain. But while incentives packed into the IRA bill make new investment more attractive, Hanwha would only be building on an already strong base of U.S. operations that started long before the Act was signed.

Hanwha Qcells, the company’s solar panel manufacturing division, already operates the largest solar module production facility in the U.S. through its Georgia-based factory, producing 1.7 gigawatts of solar modules per year. In Texas, Qcells’ 380-megawatt-hour solar energy storage system stores enough electricity for 154,000 Texas residents to use in a day.

The company's operations extend beyond American borders, too, with wind and solar projects across Asia and Europe. Hanwha Solutions is currently expanding European operations through Q ENERGY, its European subsidiary, with projects like the solar power plant it’s building in Germany with Frankfurt-based Enviria, a plant that will be capable of delivering 500 megawatts of power. In South Korea, Hanwha has plans to invest USD $3.3 billion in clean energy over the next five years while building a hub for solar R&D.

Hanwha’s global projects won’t help it benefit from the IRA’s incentives directly, but they provide a framework for future commitments that governments and partners in the U.S. can trust, offering the kind of reassurance that could help bring the highest goals of the IRA to fruition.

Ultimately, Hanwha has bigger plans of creating a full solar value chain that uses clean methods to produce and deploy highly efficient panels in the U.S., from raw materials to finished products. To that end, Hanwha Solutions recently acquired a further 4.67% in addition to its existing 16.67% stake in REC Silicon. A Norway-based polysilicon manufacturer, REC Silicon operates two manufacturing facilities in the U.S.—one in Moses Lake, Washington, and the other in Butte, Montana. While the facility in Montana makes electronic-grade polysilicon, the facility in Washington is capable of producing up to 16,000 MT of granular, solar-grade polysilicon, making REC eligible for the incentives in the IRA bill which encourage production of materials intended for solar panel production. REC has the capacity to produce highly efficient polysilicon (a key component of today’s solar panels) using some of the cleanest methods available, including plans to derive energy from hydropower.

The additional investment in REC Silicon will expand Hanwha’s network and strengthen the company’s ability to build out clean solar tech with low emissions even during the manufacturing stage. The strength of that network is growing, with REC recently signing an MOU with Mississippi Silicon, another domestic producer, to negotiate raw material supply and help build a low-carbon and fully traceable U.S.-based solar supply chain. Hanwha’s solar supply chain investments further support the Biden administration’s efforts to increase solar power generation by 40% and to decarbonize all electricity by 2035.

High Time for Hydrogen

Incentives in the IRA could spark a new wave of development in one clean fuel source in particular: hydrogen. A renewable fuel source, hydrogen has been gaining attention for its potential as a clean fuel-of-choice for hard-to-abate industries like manufacturing and energy production. That mainly comes down to hydrogen’s ability to be burned for fuel like oil and gas without producing any CO2 emissions, stirring hopes that it might be able to replace some fossil fuels or at least lower the amount used in industrial operations.

With USD $5.3 billion set aside in the IRA for projects that reduce CO2 emissions in the industrial sector, hydrogen has the potential to play a major role in the green transition. The Act offers tax credits for producers who make hydrogen domestically as long as they meet certain criteria. By subsidizing production, the Act could help jumpstart a larger buildout of hydrogen infrastructure, making hydrogen both cheaper and more abundant while also encouraging the use of other green technologies like carbon capture, which can be used to make hydrogen production more eco-friendly.

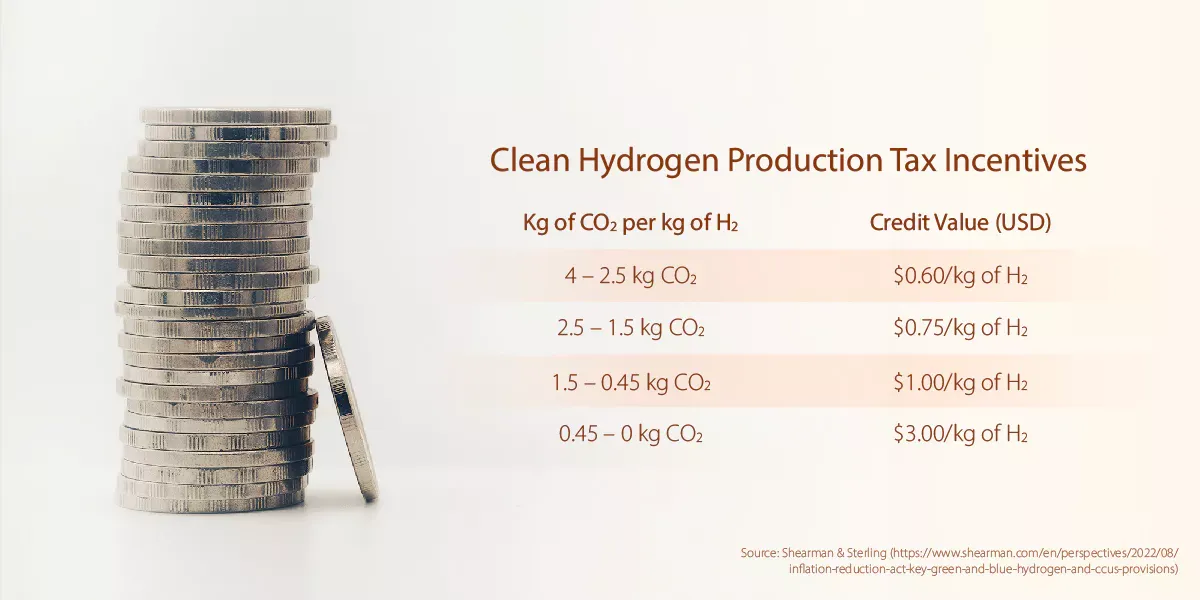

One of the key incentives for hydrogen production in the Act is the addition of Section 45V to the U.S. Internal Revenue Code. This section stipulates that hydrogen production facilities that went into service after 2012 are eligible for tax incentives on the hydrogen they produce, so long as that hydrogen meets the emissions standards laid out by the Act and the producer abides by wage and apprenticeship agreements in the Act. Hydrogen producers who can keep carbon levels below 0.45 kilograms of CO2 equivalent (CO2e) per kilogram of hydrogen can receive as much as USD $3 per kg of clean hydrogen produced.

Producers who fall short of that target while still making an effort to cut carbon emissions remain eligible for incentives, but on a sliding scale in step with the amount of carbon they emit. For example, capping emissions at 1.5 kg of carbon for every kilogram of hydrogen will earn producers up to 33.4% of the total USD $3/kg incentive, while hydrogen makers who keep carbon levels below 2.5 kg can receive up to 25%. The Act allows incentives for producers who cap carbon emissions at 4 kg, with carbon emitters in the upper allowable range eligible to receive 20% of the total incentive.

The Act is set to offer these incentives for a 10-year period, starting in December 2022 and wrapping up in January 2033, giving producers a full decade to subsidize their hydrogen production as long as the production occurs within the U.S.

Carbon capture is another clean tech tool being encouraged by the Act, and one that could help hydrogen producers keep a lid on emissions. The Act significantly boosts the incentives of Section 45Q, raising the value of tax credits per ton to USD $85/metric ton for captured carbon stored in geologic formations, along with USD $60/metric ton for the use of captured carbon emissions.

What does this mean for hydrogen? The majority of hydrogen produced in the U.S. today falls under the “grey” category, meaning hydrogen that was produced without using carbon capture to rein in the carbon emissions released during its production. Grey hydrogen currently accounts for some 95% of U.S.-made hydrogen. The carbon capture tax credits in the IRA incentivize the production of what’s called “blue” hydrogen (made with the aid of carbon capture to decrease carbon emissions from manufacturing) and green hydrogen (made using energy from renewables, producing little or no carbon emissions from start to finish).

In practice, the policy is designed to encourage factories that run on renewable energy or take responsibility for the carbon they produce by capturing as much of it as possible. It’s a policy that could spell advantages for companies like Hanwha, which is already looking into cost-effective ways to create greener and cleaner hydrogen using renewable energy. And as one of the world’s largest solar panel producers, with plans to build out its solar panel value chain, Hanwha has the renewable energy portfolio to make clean factories like this a reality.

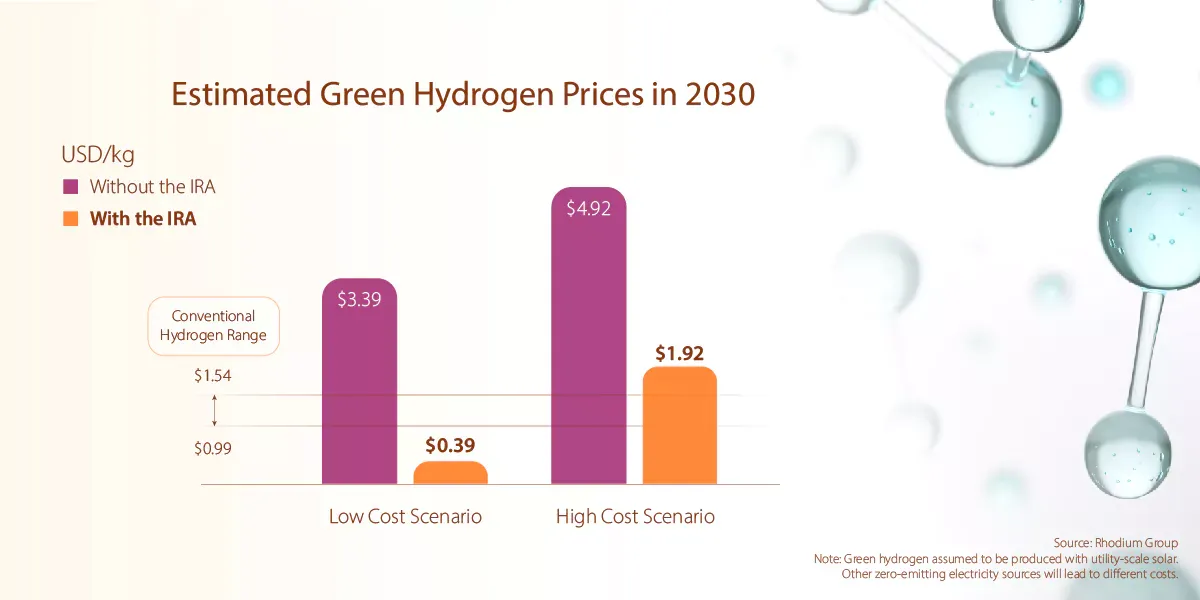

Overall, the IRA incentives are designed to create momentum for the budding hydrogen industry, fast-forwarding the buildout of infrastructure and spurring new innovation. If they succeed, the benefits could be far reaching. In 2019, the International Energy Agency called hydrogen a tool with “vast potential” for tackling today’s climate issues. A push from incentives in the IRA could be a turning point that allows hydrogen to enter the mainstream, lowering costs for both producers and potential users and making it an attractive alternative to conventional energy sources.

That influx of cheaper hydrogen could in turn accelerate other segments of the hydrogen business, like the retrofitting of gas turbines to burn hydrogen. Over the past two years, Hanwha has emerged globally as a leader in retrofitting aging gas turbines to burn a combination of natural gas and hydrogen—a process that involves phasing out natural gas and using more hydrogen in its place. In addition to overseeing retrofitting projects in Europe, including retooling a gas turbine in Rotterdam to burn at least 30% hydrogen through its Dutch subsidiary Thomassen Energy, Hanwha is also involved in a project to retrofit a gas turbine in Linden, New Jersey to burn 40% hydrogen through its subsidiary, Power Systems Mfg (PSM).

If the IRA can help bring down hydrogen prices while increasing supplies, projects like this could become more common, raising demand for cheaper, cleaner hydrogen even further and integrating this powerful fuel source into the broader economy—a shift that could be the key to decarbonizing hard-to-abate industries.

The impacts on the broader hydrogen economy don’t stop there. As hydrogen becomes more affordable and easier to produce, demand could also begin to rise. That uptick in hydrogen use could create a windfall for Hanwha’s storage tank business and drive tank production, increasing its ability to support other companies in their hydrogen projects. Hanwha is already building hydrogen storage tanks with advanced capabilities like its flagship Neptune IV—a hydrogen storage tank with a unique anti-buckling technology that allows it to be completely emptied without buckling. Hanwha has already finalized a purchase order to provide a number of its Neptune tanks to U.S. energy giant Shell as part of a plan to build out hydrogen charging stations for vehicles that run on hydrogen fuel cells.

If the IRA bill succeeds in spurring new innovation in clean hydrogen, the benefits could spill over to the hydrogen industry globally, making the U.S. a highly competitive country for producing a clean fuel source with a vast potential to help the fight against climate change.

Conclusion

Hanwha is proud to help build a sustainable future for America.

Whether it’s in solar, wind, hydrogen, or another renewable energy stream, the incentives from the IRA pave the way for progress, opening the door for companies like Hanwha to make deeper commitments and drive much-needed innovation in the space.

The goals in the IRA won’t be realized on their own. Making them a reality will take close cooperation from clean tech leaders with a strong track record and the infrastructure to see projects through. With its global portfolio of solar, hydrogen, and wind power projects, Hanwha is well-positioned to play a key part in bringing the goals of the IRA to fruition.

you need more information? refer here