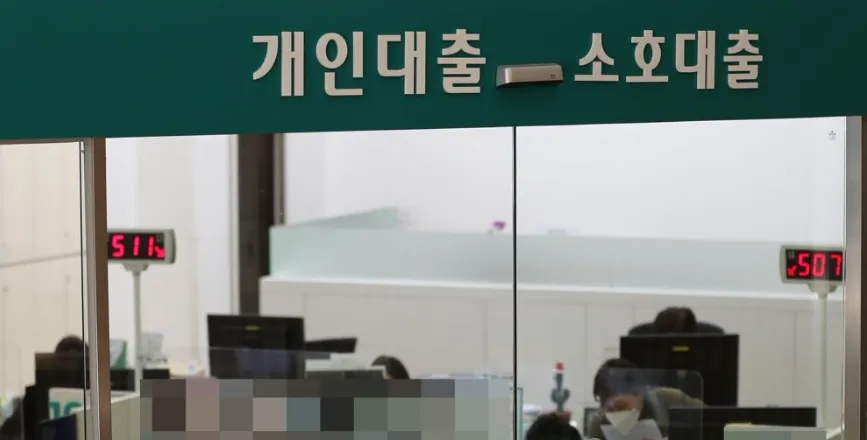

The loan interest rate in the 7% range that is solidifying...If you take the big step of the Bank of Korea, 8% is also "in front of your eyes."

The era of loan interest rates in the 7% range is opening for the first time in about 13 years in the wake of a hike in the benchmark interest rate and a rise in market interest rates.

The upper part of commercial banks' mortgage rates seems to be solidifying in the 7% range.And this is because the interest rate on credit loans and lease loans is close to 7%.

Moreover, as the Bank of Korea is likely to make a big step (a 0.50 percentage point increase in the benchmark interest rate) at least once by the end of the year, some predict that the loan rate will rise to 8 percent soon.

As interest rates soared, the trend of "reverse money movement" also accelerated, with household loans from the five major banks backing down for nine consecutive months and nearly 30 trillion won in regular deposits and installment savings flocking in just a month.

The loan interest rate in the 7% range that is solidifying...If you take Han's big step, 8% is "in front of your eyes."

The loan interest rate in the 7% range that is solidifying...If you take Han's big step, 8% is "in front of your eyes."

(Seoul = Yonhap News) Reporter Baek Seung-ryul. 2021.4.14 srbaek@yna.co.kr

The loan interest rate jumped by up to 0.35% in a week.4% credit goes away

As of the 30th of last month, KB Kookmin, Shinhan, Hana, and Woori Bank's mixed (fixed) mortgage rates are 4.730 to 7.141% per year.

Compared to September 23, just a week ago (4.380~6.829 percent), the top rose 0.312 percentage points (p) and the bottom rose 0.350 percentage points.

This is because interest rates on five-year bank bonds (AAA, non-guaranteed), which are mainly used as an indicator of mixed interest rates on mortgage loans, continue to rise due to expectations of faster-than-expected tightening in the U.S. and Korea.

On the 27th of last month, Hana Bank's mixed-type (five-year financial bond indicator) interest rate exceeded 7%, and Woori Bank's mixed-type interest rate also exceeded 7%.

Compared to the fact that Woori Bank alone briefly hit 7% in mid-June and soon fell to the early and mid-6% range, the atmosphere is somewhat different.

The variable rate of mortgage loans (linked to the new COFIX) is currently 4.510~6.813% per year. The top and bottom also rose 0.205% points and 0.310% points, respectively, compared to a week ago (4.200-6.608%).

If COFIX, an indicator of variable interest rates, raises again as expected in the middle of this month, the floating rate is likely to surpass 7% soon.

Interest rates on credit loans and lease loans are also in the 7% range.

As the interest rate on credit loans (grade 1 and 1 year) rose from 4.903 to 6.470% per year to 5.108 to 6.810%, interest rates in the 4% range disappeared.

The interest rate on jeonse loans (two-year guarantee of the Korea Housing Finance Corporation), a representative loan product for ordinary people, also jumped to 4.260-6.565 percent per year.

refer more information - refer